tax ease ohio make a payment

The Newark School District Income Tax is collected by the State of Ohio see Guide to Links for more information. For general payment questions call us toll-free at 1-800.

Prior Year Tax Return Software File Previous Year Taxes With Freetaxusa

After you pay your bill you will be.

. Tax Ease Ohio LLC. For general payment questions call us toll-free at 1-800. Thank you for visitingTax Ease Ohio Customer Portal.

Tax Ease Ohio LLC. Make payments on the online payment portal. Several options are available for paying your Ohio andor school district income tax.

If your tax debt is rising consider a property tax loan from Tax Ease. It is also known as an installment agreement IA. Make payments on the online payment portal.

Ohio State Tax Payment Plan Options. Several options are available for paying your Ohio andor school district income tax. You can still pay your bills online without signing up by entering your account number and zip code below.

Weve helped Texas residents just like you get out from under their property tax debt with an affordable payment. Tax ease ohio make a payment. The average effective property tax rate in Ohio is 156 which ranks as the 12th highest in the US.

Income Tax Guest Payment Service allows taxpayers to schedule and remit payments for Individual and. If you have trouble finding your property please e-mail or call us. In Ohio if you are unable to pay off state tax liabilities in full you can pursue a payment plan.

For general payment questions call us toll-free at 1-800. How long can property taxes go unpaid in Ohio. TAX EASE OHIO Email email protected Payoff Portal.

The Newark Income Tax Office. Cite as Tax Ease Ohio II LLC. Motion Di October 05 2022 Edit.

If you have any questions at all please. Finally Vowels averred that Tax. Email protected Customer Service.

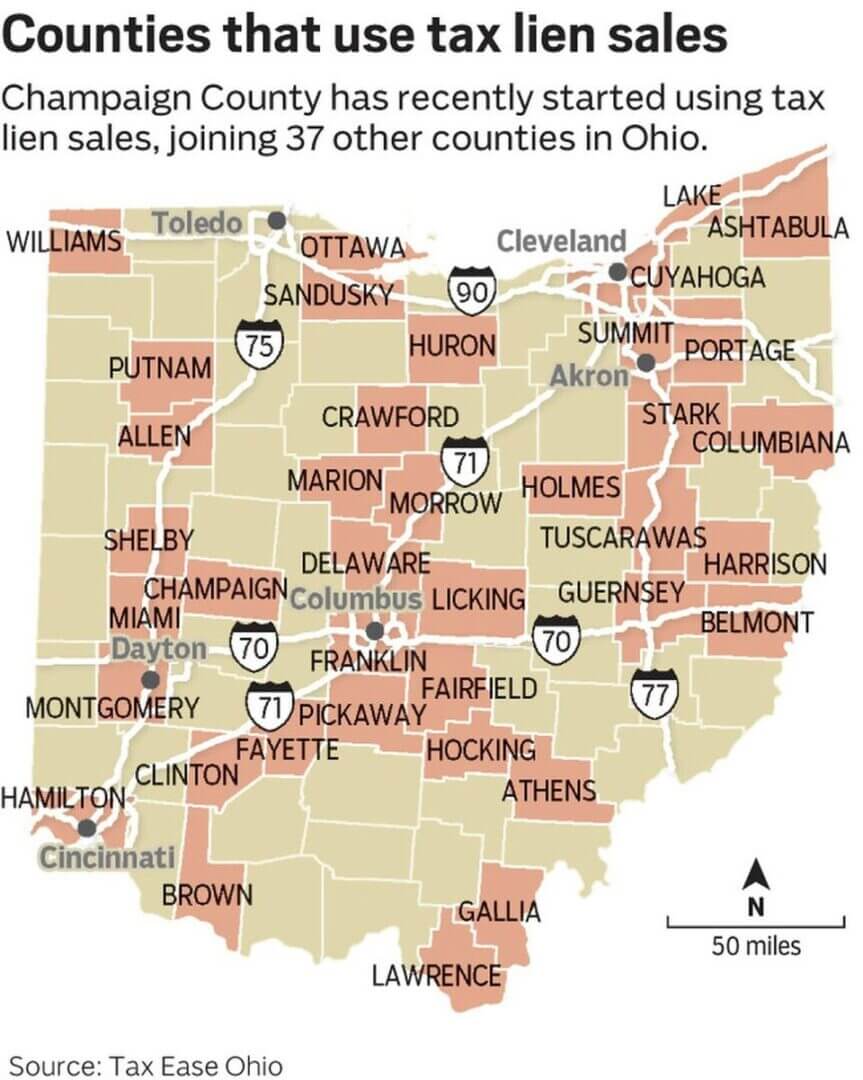

After an Oho tax lien sale. Leach 2021-Ohio-2841 COURT OF APPEALS OF OHIO EIGHTH APPELLATE DISTRICT COUNTY OF CUYAHOGA. If your ready to move forward with your property tax loan please call us at 888 743-7993 or fill our an application on our application page.

7am 6pm EST M-F Live Answering. 1-866-907-2626 Call Center Hours. The Newark Tax rate is 175.

The Ohio Treasurers office is required to collect certain types of payments on behalf of the State of Ohio as well as payments for Treasury. Payments by Electronic Check or CreditDebit Card. Payments by Electronic Check or CreditDebit Card.

Security Key 1 - Property Zip Code. Welcome to the Ohio Department of Taxation Income Tax Guest Payment Service. 7 AM - 6 PM EST M-F Live Answering.

Clipping From Dayton Daily News Newspapers Com

Fieldhouse Usa Land Subject Of Suit Against Polaris Mall

Sales Tax Changes 2022 Avalara

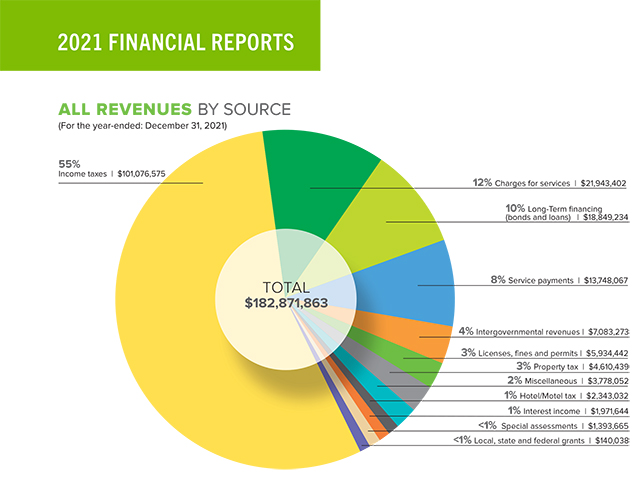

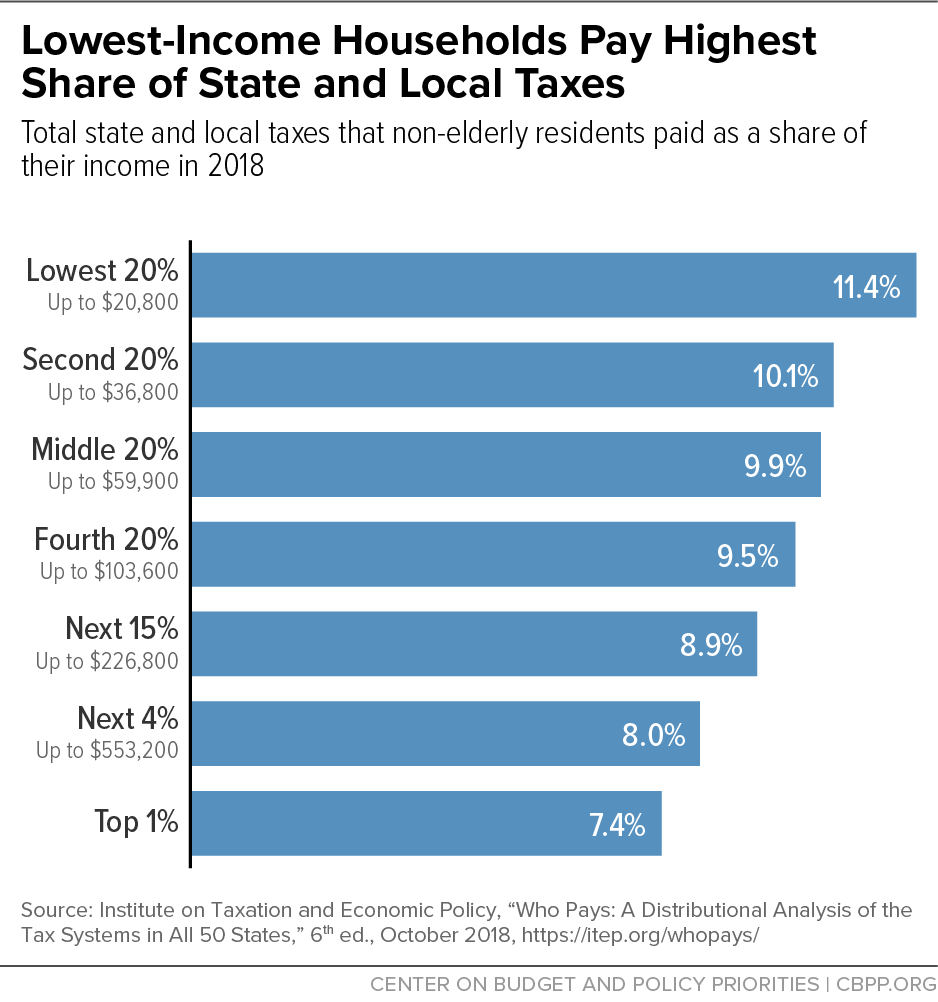

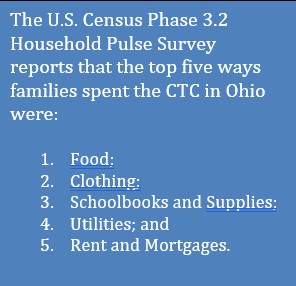

Ending Child Poverty Children S Defense Fund Ohio

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Tax Ease Ohio Address German Holden

How To Pay The Treasurer S Office Of Clermont County Ohio

Coronavirus Tax Relief Covid 19 Tax Resources Tax Foundation

Ohio Budget Offers Significant Tax Savings

Complaint Receipt 1271268 Date 10 25 2019 Foreclosure Of Tax Liens Vested In Tax Ease Ohio Llc With The Attached Preliminary Judicial Report And Notice Under The Fair Debt Collection Practices Act Filed By

Tax Ease Ohio Company Profile Acquisition Investors Pitchbook

Sandusky County Ohio Treasurer

Investing In Tax Liens In Ohio Joseph Joseph Hanna

Nj To End Temporary Work From Home Tax Rules Nj Spotlight News